Intelligence-Led Testing for Financial Services

TIBER-EU and CBEST represent the gold standard in threat intelligence-led testing frameworks. Designed specifically to test organisational resilience against sophisticated, realistic cyber attacks informed by genuine threat intelligence

We offer non-regulated, threat-led assessments inspired by the same principles and focused on realistic attacker scenarios. We deliver threat intelligence using methodologies aligned with these frameworks, bringing sophisticated intelligence capability to financial institutions, fintech companies, and organizations preparing for or aspiring to this level of security maturity.

What Makes Threat-Led different?

Traditional penetration testing asks: “What vulnerabilities exist?”

TIBER-EU and CBEST ask: “How would real threat actors targeting our organization actually attack us?”

The difference is fundamental:

Traditional Testing

Generic test scenarios, template-based approach, technical focus, vulnerability identification, point-in-time assessment.

TIBER-EU/CBEST Approach

Bespoke threat scenarios, intelligence-driven methodology, adversary emulation, resilience testing across people/process/technology, business impact focus.

This methodology requires genuine threat intelligence capability, not just technical testing skills, but the ability to research, analyse, and translate threat actor behavior into realistic test scenarios.

Intelligence Products we Deliver?

Comprehensive intelligence assessment including:

- Executive summary for leadership and governance

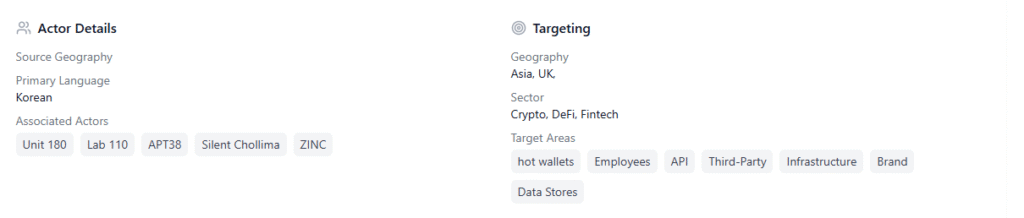

- Threat actor landscape analysis

- Detailed threat actor profiles for priority adversaries

- Attack scenario narratives with supporting intelligence

- Technical appendices with TTPs, IOCs, and reference materials

- Intelligence confidence assessments and source attribution

Intelligence packages for red team operations:

- Detailed TTP breakdowns for specific threat actors

- Attack chain documentation from intelligence sources

- Tool and technique specifications

- Operational security considerations

- Success criteria based on threat actor objectives

For executive stakeholders and boards:

- Clear articulation of threat landscape

- Business context for why these threats matter

- Risk assessment based on threat intelligence

- Recommendations for control improvements

- Regulatory and compliance context

Who is this for?

Financial Services

Banks, payment processors, financial market infrastructure, and investment firms subject to or preparing for TIBER-EU or CBEST requirements.

Organisations Preparing for Regulatory Testing

Companies building toward mandatory TIBER-EU or CBEST who want to experience the methodology and build internal understanding before formal requirements.

FinTech Companies

Rapidly growing organisations who need to demonstrate security maturity to regulators, investors, and customers through sophisticated testing.

Security Teams Seeking Intelligence Maturity

Organizations wanting to evolve from vulnerability-focused testing to genuine threat intelligence-led security validation.

Tier 2 & Tier 3 Financial Institutions

Regional banks, credit unions, and smaller financial entities who want TIBER-EU/CBEST sophistication without the regulatory overhead or Big 4 pricing.

Get Started

Let's discuss your Threat-Led Assessment.

Whether you need a one-time threat landscape assessment or ongoing intelligence reporting, we'll work with you to design an intelligence program that fits your needs and budget.